Minimally Invasive Surgery Market Growth

Report Overview

The global minimally invasive surgical instruments market size was valued at USD 13.3 billion in 2020 and is anticipated to grow at a compound annual growth rate (CAGR) of 14.5% over the forecast period. Surgical robots have revolutionized the field of Minimally Invasive Surgeries (MIS) and their acceptance by surgeons is rising globally. The cost of MIS procedures is significantly less than in-patient and conventional open surgeries with equal outcomes resulting in a significant increase in value for the patient as well as insurance providers. This trend is likely to continue in the coming years. Minimally invasive surgeries are much less traumatic than conventional open surgeries. Traditional surgeries performed with conventional laparoscopic instruments can be traumatic and complex.

Minimally invasive laparoscopic cameras are inserted through smaller incisions and specialized smaller instruments are used to operate. The healing process is less painful and patients can recover fastest after MIS. Minimally invasive procedures are gaining popularity due to quicker recovery, smaller incisions, reduced scarring & pain, increased accuracy, and shorter hospital stays. Medical displays ensure superior visibility of diagnostic images, displaying even the slightest difference in tissues and cells, ensuring precise and quicker surgeries.

The consistent technological advancements in this field provide higher-quality instruments that allow the surgeons to perform the surgical interventions efficiently without sacrificing patient safety. The improved product designs provide a level of control and accuracy in the operating room. It is highly beneficial for the treatment of breast cancer, abdominal surgeries, cardiac, orthopedic, ophthalmic, neurological, and oral surgical procedures. It is said to be the best choice over open surgeries, especially in geriatric patients, as the healing time is drastically reduced.

In addition, studies suggest that Virtual Reality (VR) when combined with display devices in the Operating Rooms (ORs), improves the visualization of tissues and its handling at inaccessible internal spots, ultimately improving accuracy during MIS. VR helps evaluate various conditions and treatment alternatives on virtual patients before the actual treatment technique is performed in a care setting. Advancements in instrumentation and video imaging are likely to renovate several procedures in various surgical specialties from open to endoscopic surgeries. MIS techniques have been used to reduce the complications related to open exposures, such as infection and wound post lumbar spine fusion surgery.

Furthermore, market leaders like Medtronic, Abbott, Zimmer Biomet have launched newer products with robotic-assisted technology. For instance, in 2020, Medtronic entered into a definitive agreement with Titan Medical to develop robot-assisted surgical technologies. Also, in 2020, Abbott launched a minimally invasive heart valve repair device to treat mitral regurgitation in India. The company's product, IonicRF Generator, delivers minimally invasive, nonsurgical treatment for pain management in the nervous system.

Despite huge investment in R&D and product launches with advanced features, the market witnessed a dip in 2020 due to the outbreak of COVID-19. Nation-wide lockdowns, restrictions on logistics movements, lack of resource availability, and, most importantly, the economic instability of hospitals & end-use settings led to the fall of the market. A dramatic decline in elective surgeries, by nearly 50%, across the globe, cancellation of planned laparoscopic surgeries for the year 2020 and early 2021, reduced medical staff, increased workload on surgeons, and risk associated with viral spread also fueled the market drop. However, it is said that the market will rise sharply by early 2022.

Device Insights

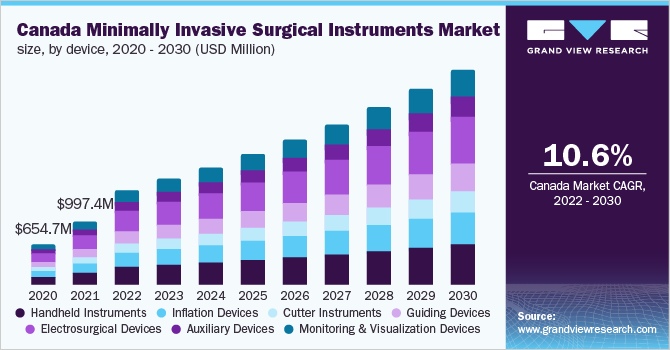

In 2020, the handheld instruments segment dominated the market with a revenue share of more than 22%. Handheld instruments used in MIS techniques target reducing the amount of damage to extraneous tissue surgical procedures, thereby speeding patient recovery time and reducing discomfort & side effects. Most of the instruments in the MIS market are single-use products. The segment is driven by technological innovations and the growing adoption of handheld instruments in MIS.

For instance, a low-cost mechanical instrument has been developed recently to perform minimally invasive laparoscopic surgeries. These handheld devices can be either mechanical, robotic, or semi-automated. Handheld devices ensure easier access during surgery with instrument triangulation, thereby reducing the risk of potential mistakes. Key market players of handheld instruments include Medtronic, Aesculap, Inc., Stryker, and Conmed Corp.

Application Insights

The orthopedic application segment dominated the market with a revenue share of over 23.5% in 2020. In orthopedic MIS procedures, no muscles need to be cut or separated from the bone. Therefore, this approach has led to improved patient satisfaction and a faster healing process. Most often, MIS is utilized in hip as well as knee replacement surgeries. Hospitals and surgeons seek surgical procedures that result in fewer operative as well as postoperative complications and reduced hospitalization periods. On the other hand, patients seek surgical treatments that reduce trauma and allow speedy recovery.

Cardiac surgery is one of the key factors boosting the adoption of MIS. Minimally invasive surgeries have various potential benefits over conventional surgeries, such as minimal blood loss, reduction in pain & trauma, minimal risk of infection, lesser or smaller noticeable scars, faster recovery, shorter duration of hospitalization, and quicker return to normal activities. The rising incidence of Cardiovascular Diseases(CVDs) is one of the significant factors leading to an increase in the adoption of MIS over conventional ones owing to the various advantages of these surgeries.

End- u se Insights

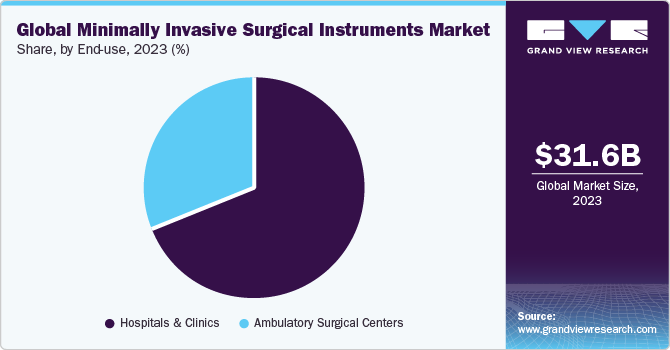

The hospital segment accounted for the maximum revenue share of over 66% in 2020. On the other hand, Ambulatory Surgical Centers (ASCs) are expected to witness the fastest CAGR over the forecast period. Currently, over 5,500 Medicare-certified ASCs are present in the U.S. Ambulatory surgical centers offer low-cost surgical procedures and greater flexibility of scheduling as compared to hospitals. Also referred to as same-day surgery centers, these medical facilities discharge patients immediately after minor surgeries.

The demand for outpatient surgeries is likely to grow dramatically in the coming years. The growth in ASCs can be attributed to several factors including a rise in minimally invasive procedures, advancement in the field of anesthesia, enhanced patient experiences, legislative changes, and economic pressures. To encourage the use of ambulatory surgical centers, Medicare waived the part B deductible for beneficiaries.

Regional Insights

North America dominated the global market in 2020 with a revenue share of 44% due to the high rate of unintentional injuries and the increasing geriatric population. According to a report by the Organization for Economic Co-operation and Development (OECD), per capita, healthcare expenditure in the U.S. is higher than all the other countries in the world. In addition, patients in the U.S. can choose methods of treatment as well as the providers. This is likely to have a positive impact on the market in North America.

On the other hand, Asia Pacific is expected to be the fastest-growing regional market from 2021 to 2028. The rising geriatric population in Japan and China increased cases of road crashes, and a rapidly developing economy is expected to promote the emergence of MIS procedures in Asia Pacific. The demand for minimally invasive procedures in this region is also driven by the growing medical tourism, mainly for cosmetic surgeries.

Key Companies & Market Share Insights

The global market is highly competitive due to the presence of leaders, such as Abbott, Zimmer Biomet, GE Healthcare, and many others. Most of their revenue is invested in R&D to develop highly interactive technology to strengthen their market position. Newer players in the market obtain heavy funding from government bodies and healthcare organizations to fuel product research and adhere to the market needs. Mergers, acquisitions, collaborations, and expansions are some of the developmental strategies undertaken by leaders to further strengthen their presence in the global market. Some of the prominent players operating in the global minimally invasive surgical instruments market include:

-

Medtronic

-

Siemens Healthineer AG

-

Ethicon, Inc. (Johnson & Johnson)

-

Depuy Synthes

-

GE Healthcare

-

Abbott Laboratories

-

Intutive Surgical, Inc.

-

Nuvasive, Inc.

-

Zimmer Biomet

M inimally Invasive Surgical Instruments Market Report Scope

| Report Attribute | Details |

| The market size value in 2021 | USD 19.96 billion |

| Revenue forecast in 2028 | USD 51.49 billion |

| Growth rate | CAGR of 14.5% from 2021 to 2028 |

| Base year for estimation | 2020 |

| Historical data | 2016 - 2019 |

| Forecast period | 2021 - 2028 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2021 to 2028 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Device, end-use, application, and region |

| Regional scope | North America; Europe; APAC; Latin America; MEA |

| Country scope | U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE |

| Key companies profiled | Medtronic; Siemens Healthineer AG; Ethicon, Inc. (Johnson & Johnson); Depuy Synthes; GE Healthcare; Abbott Laboratories; Intutive Surgical, Inc.; Nuvasive, Inc.; Zimmer Biomet |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global minimally invasive surgical instruments market report on the basis of device, application, end-use, and region:

-

Device Outlook (Revenue, USD Million, 2016 - 2028)

-

Handheld Instruments

-

Inflation Devices

-

Cutter Instruments

-

Guiding Devices

-

Electrosurgical Devices

-

Auxiliary Devices

-

Monitoring & Visualization Devices

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Cardiac

-

Gastrointestinal

-

Orthopedic

-

Vascular

-

Gynecological

-

Urological

-

Thoracic

-

Cosmetic

-

Dental

-

Others

-

-

End -u se Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global minimally invasive surgical instruments market size was estimated at USD 13.3 billion in 2020 and is expected to reach USD 19.96 billion in 2021.

b. The global minimally invasive surgical instruments market is expected to grow at a compound annual growth rate of 14.5% from 2021 to 2028 to reach USD 51.49 billion by 2028.

b. North America dominated the minimally invasive surgical instruments market with a share of 41.1% in 2020. This is attributable to the high rate of accidental injuries and large geriatric population.

b. Some key players operating in the minimally invasive surgical instruments market include Medtronic, Stryker, Smith & Nephew, Abbott, NuVasive, Inc., CONMED, Zimmer Biomet, Intuitive Surgical, Inc.

b. Key factors driving the minimally invasive surgical instruments market growth include cost-effectiveness of the procedure, improved adoption among geriatric patients, and reduction in recovery time.

Minimally Invasive Surgery Market Growth

Source: https://www.grandviewresearch.com/industry-analysis/minimally-invasive-surgical-instruments-market

0 Response to "Minimally Invasive Surgery Market Growth"

Post a Comment